The project

The main goals of the project was to decrease the churn rate using all the data available about the customers and their history.

How we handled this

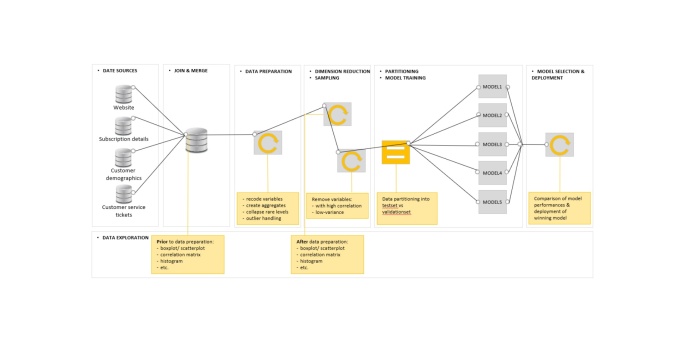

We set up a pilot to identify customers ‘at-risk’ to churn using predictive modelling and launched an email campaign to these customers with a sales offer. What we did briefly:

- Create a customer view with all available historical data: clicks on website, subscription details (GB, mins, fee), customer demographics, customer service tickets, CRM, etc.

- Train- and test different classification models on the data to identify customers ‘at-risk’. ML algorithms we used are decision tree, random forest, logistic regression, XGBoost and SVM

- Model evaluation and - selection

- Use ‘winning’ model to score existing customers resulting in a churn probability for each individual customer (satisfied customers vs customers at risk)

- Set up a campaign for customers at risk of churn

- Campaign evaluation