7. April 2022 By Anna Wäyrynen and Juhana Jutila

Are you a leader or a follower in the sustainability transformation?

New business opportunities of sustainability

Sustainability actions in companies have in many cases been driven by compliance. Regulatory requirements or de facto standards guide companies, but simultaniously also customers, partners and investors are looking at companies’ sustainability actions. Leading companies have established a "standard" that other companies are looking as a measuring stick for their own sustainability efforts. If this trend truly drives companies' efforts forward with good enough speed, it's all positive. However just following others keeps the companies in the compliance mindset and they may either miss the new business opportunities enabled by this new transformational force or give the first mover advantage to competitors.

When evaluating sustainability efforts and opportunities beyond the compliance one of the first questions is naturally the business case or ROI. Are there really measurable business reasons why we should invest in sustainability more than the regulation or de facto standards require or more than our closest competitors?

Categorizing sustainability benefits

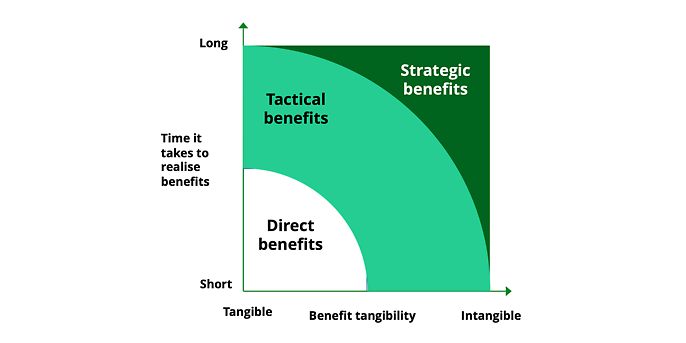

As a starter it is beneficial to find a way to categorize the different sustainability benefits. For that purpose we have created a framework where sustainability benefits are analysed with two factors:

- Tangibility – how concrete the benefit is, how easily the benefit can be measured and valued?

- Time to realise – how long does it take to realise the benefits from actions or investments?

Using these factors we can use following benefit categorization:

- 1. The quickly realized tangible benefits are "direct benefits"

- 2. Benefits in the middle ground are "tactical benefits"

- 3. The most intangible and long-term benefits are "strategic benefits"

Often business cases concentrate on direct benefits (and costs) only since by definition they are concrete and easily measurable. Since sustainability is not a one-time investment but rather a transformational force impacting companies into the foreseeable future, one needs to investigate also the more intangible or longer-term benefits to understand the full picture.

Using the above categorization, we can make a number of observations:

- It is relatively straightforward to find cost savings-type direct sustainability benefits like less energy costs or less CO2 emission allowance costs to justify certain investments in e.g. manufacturing processes. These are typically the first type of investments companies make, they are tangible and bring benefits relatively quickly after the changes have been implemented.

- Some companies however already make major investments e.g. in new raw materials, increased use of green energy etc. which bring benefits to the sustainability footprint, but from traditional business case wise may seem overkill investments.

- Some companies could be seen to use a large sustainability budget with the similar logic as a large marketing budget to grab market attention. Does this mean that sustainability has become just another marketing battleground?

Since few companies are willing to dramatically decrease their profitability with high sustainability investments, companies with higher sustainability investment levels are more likely including more tactical and strategic benefits into their sustainability investment evaluations. They simply have a longer perspective than companies that concentrate on the short-term tangible benefits only.

Getting beyond the direct benefits - how to use tactical and strategic benefits

Due to the transformational nature of sustainability – it is impacting most if not all areas of company’s operations. There are a lot of potential benefits which are not easy to quantify directly nor obvious with a short timescale. Instead of immediately diving into complex life cycle analysis or cost-benefit analysis methodologies, there is a reasonably straightforward way to approach many tactical and strategic sustainability benefits using a value creation - value capture model.

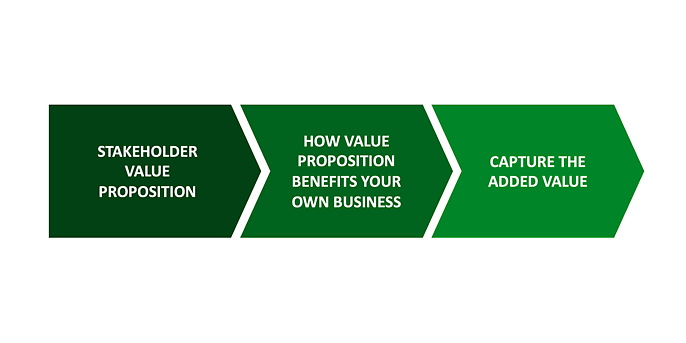

The basic idea is to investigate how a certain action adds value to a stakeholder (value creation) and then how this added value could be used to increase your revenues or profits (value capture). Using this approach, we get three main steps:

- 1. Identify your sustainability value proposition to each of your stakeholders - which things add value to them. For example for a customer the value is often related to the key purchase criteria and for an investor their investment criteria.

- 2. Identify how your new stakeholder value proposition can benefit your own business. It may be for example additional sales opportunities, increased customer NPS or better access to investment capital.

- 3. Identify how you can capture that added stakeholder value – basically either via increased revenues or better profits (due to e.g. cost savings or higher prices).

When sustainability benefits are analyzed using the above tangibility – time-to-realise -framework as a starting point, companies can gain better understanding of the business impact and opportunities derived from their sustainability actions. This gives better possibilities to analyse how to be a leader and not just a follower in the sustainability transformation.